The United Arab Emirates Ministry of Finance has announced the introduction of federal corporate taxation for the first time ever. Tax on business profits will be take effect for financial years starting 1 June 2023.

The announcement comes after international pressure for global tax standards, including OECD plans to implement a 15% global minimum tax on multinational corporations. Despite soaring oil prices currently generating vast revenues for the Emirates, there has long been a need for the government to find alternative sources to fill its coffers. This was apparent during recent years of slumping oil prices, which saw the UAE and other GCC oil producers introduce VAT in 2017, as well as increased import taxes, to support their ambitious development programs.

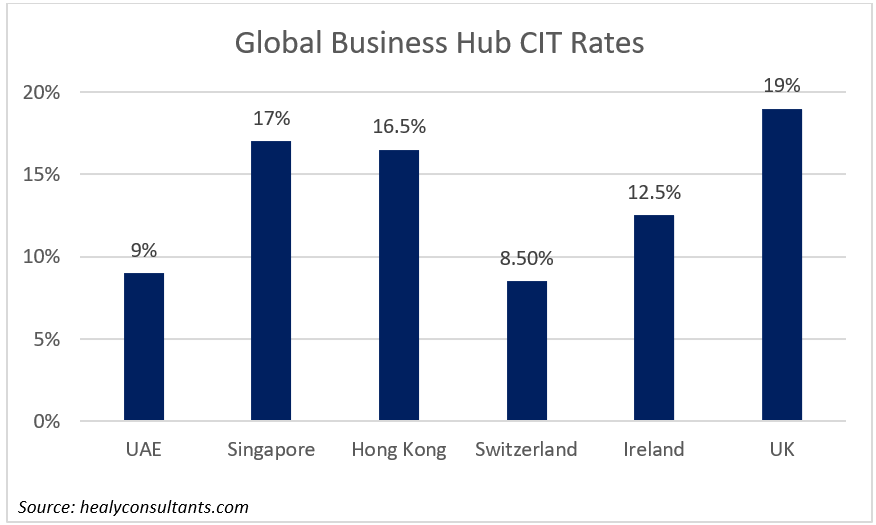

This will mark the end of the UAE’s tax-free environment that helped establish it as a global business hub and financial center. However, at just 9%, the headline corporate tax rate remains one of the most attractive both regionally and globally. Businesses with taxable income of less than AED 375,000 (US$100,000 approx.) will be exempt from tax, supporting startups and small businesses. Additionally, companies that operate within the country’s free zones will continue to benefit from zero taxes if they do not deal with the mainland.

In comparison to regional Corporate Income Tax (CIT) rates, the UAE will continue to have lower rates for foreign businesses than its GCC competition. Only Bahrain currently remains tax-free for foreign corporations. However, as Bahrain continues to struggle to balance its budget, it appears likely that it, too, will be forced to follow suit to generate much needed revenue. As the UAE continues its contest with Saudi Arabia to retain its position as the region’s commercial hub, this announcement appears to be a step back from other measures introduced over the past two years such as improved legislation on intellectual property rights, corporate ownership rights and incentives for top talent. At 20%, Saudi tax for foreign corporations will remain 11% higher, but the increasing cost of doing business in the UAE is a competitive concession.

Multinational corporations will, inevitably, not be pleased with an increase in incurred costs. However, it is unlikely to be a significant deterrent. Worldwide average statutory corporate income tax in 2021 stood at 23.54%, and other ‘low tax’ hubs, such as Singapore and Hong Kong, impose taxes at nearly double the UAE’s proposed rate. Additionally, the absence of personal income tax and lifestyle offered in the Emirates will continue to be desirable for the top talent driving these organizations.

For more information on UAE business setup and tax accounting, visit https://www.healyconsultants.com/uae-company-registration/.

Healy Consultants Group provides a wide range of corporate services across the world. Email or WhatsApp us now to find out more about our services.